I took a sabbatical in 2025 to figure out the next chapter of my career. I ultimately turned my attention to energy–specifically, electric power. I coalesced my thoughts into the essay below. Much of my thinking was inspired by posts from Casey Handmer, Austin Vernon, Brian Potter, and Noah Smith. Insights are theirs; errors are mine.

Since writing this in July, I joined Gridmatic to accelerate deployment of cheaper, cleaner energy onto the grid.

Thank you to Michael Retchin for encouraging me to share this essay. I'm a few months delinquent, but better late than never.

Why I want to work on energy

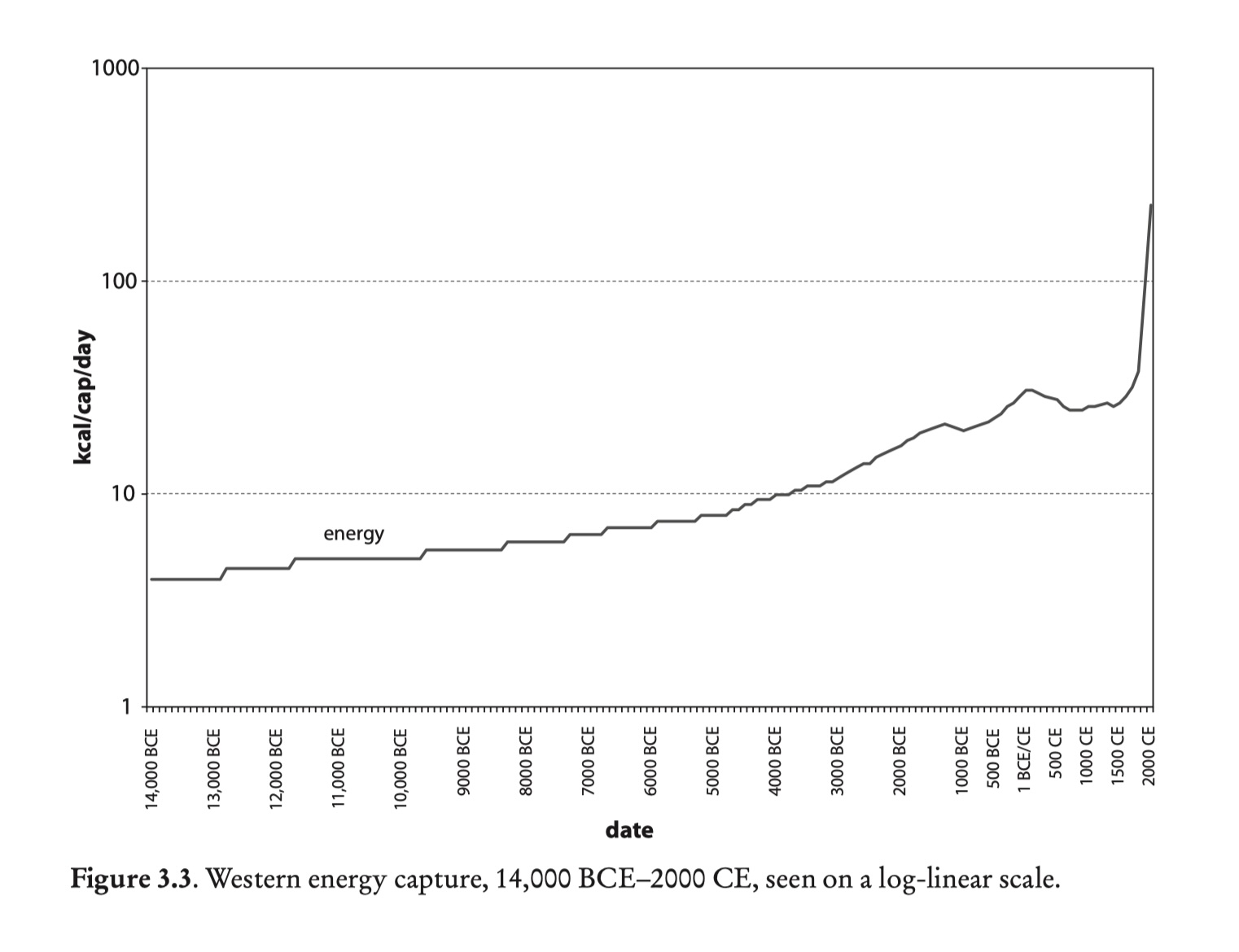

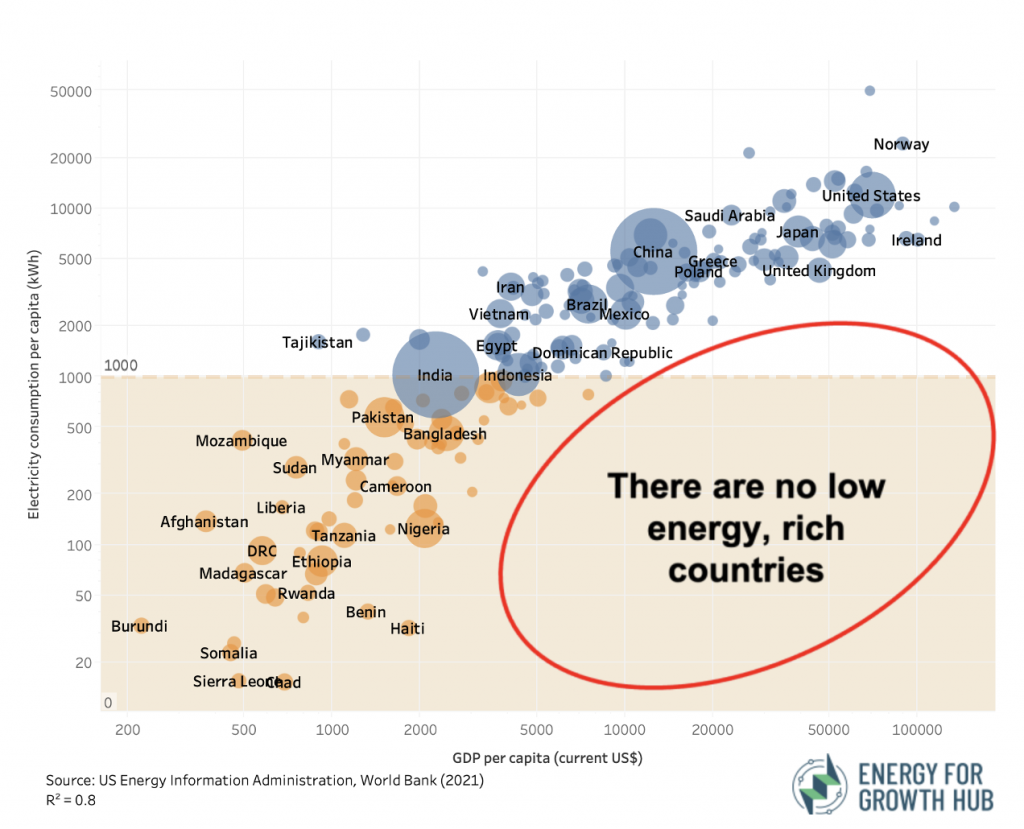

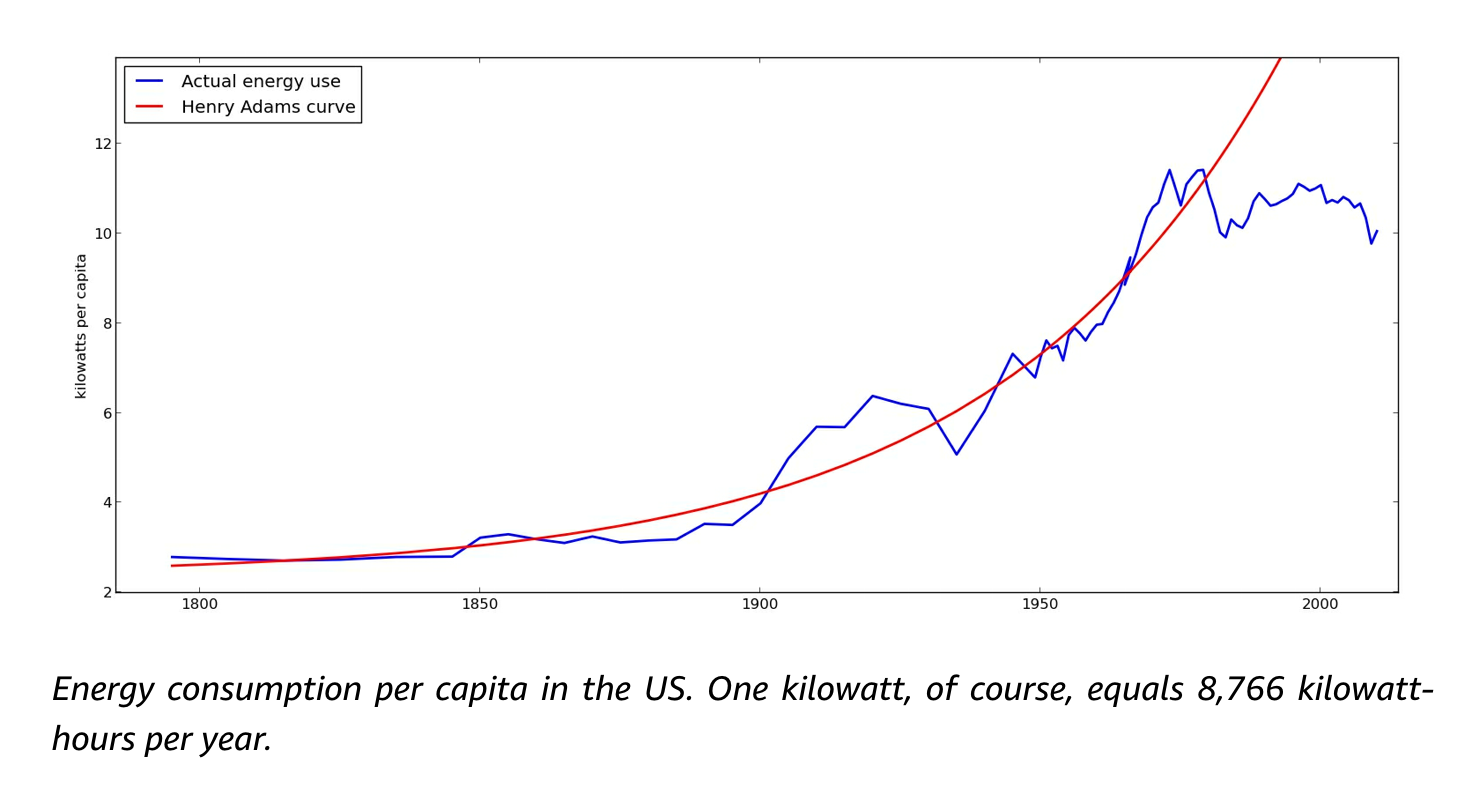

Our ability to harness and use energy is directly correlated with almost all measures of human development. These trends have held over millennia; you can see the fall of the Roman Empire in the data. Energy consumption has accelerated since the industrial revolution, as have most measures of well-being, including life expectancy, economic output, and total factor productivity.

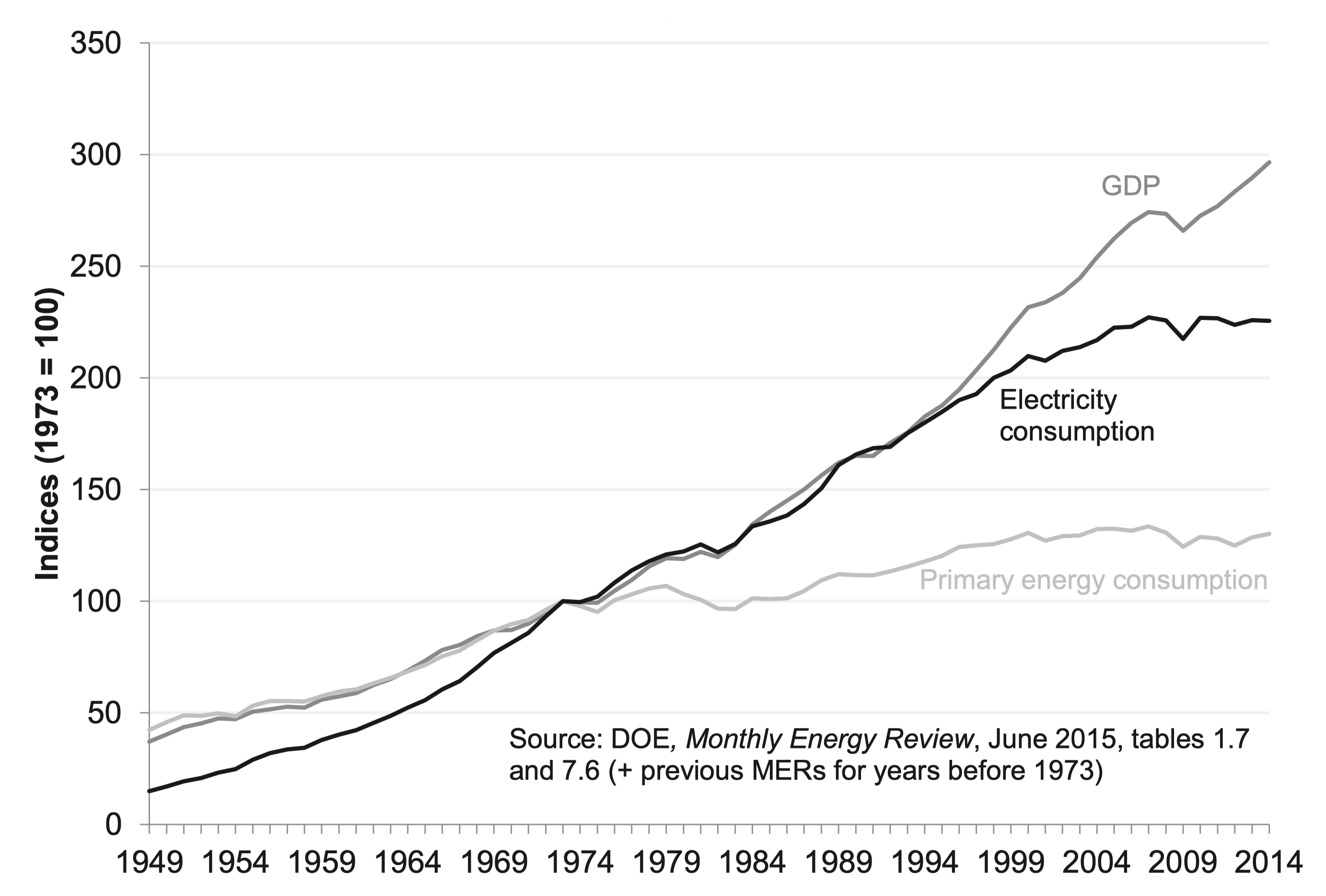

The last few decades—since the 1970’s—are the first time in human history we’ve enjoyed GDP growth in the US without a corresponding growth in energy usage. That said, things haven’t exactly been great since then. We ride on public transit from the 1920’s. We get water via pipes from the 1940’s. We fly in airplanes from the 1960’s. We take high speed rail from... oh wait.

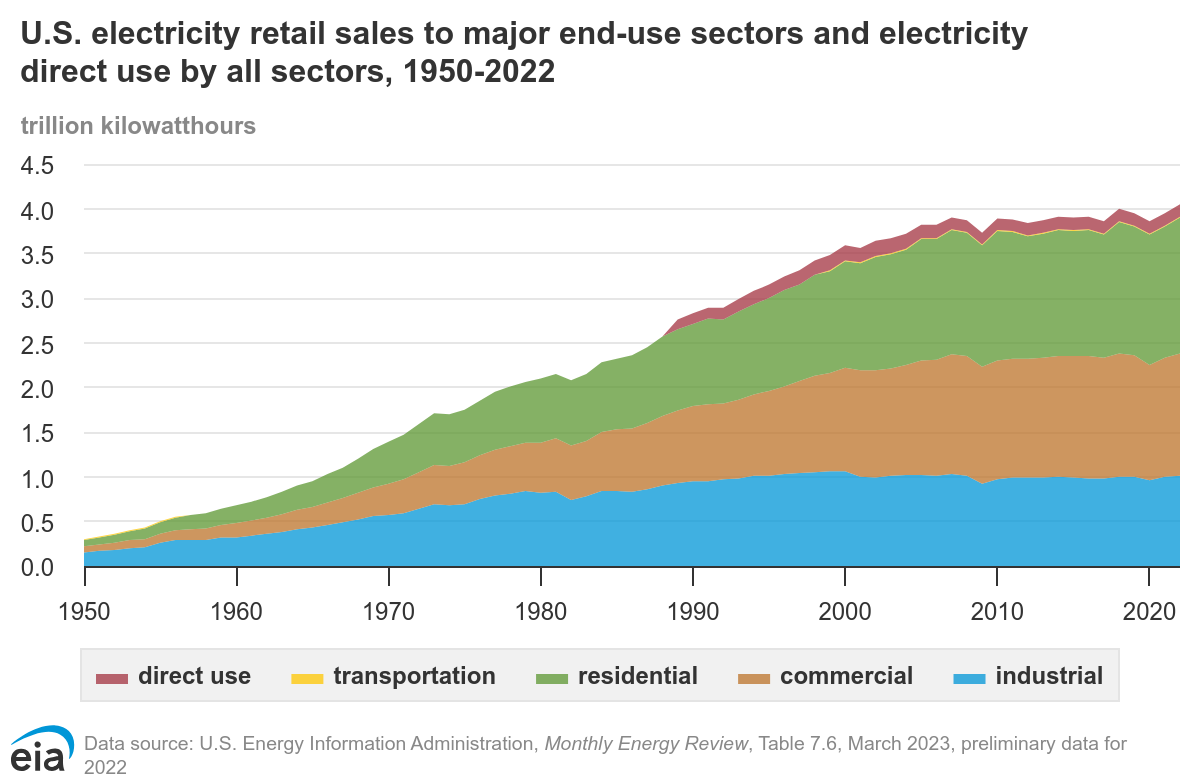

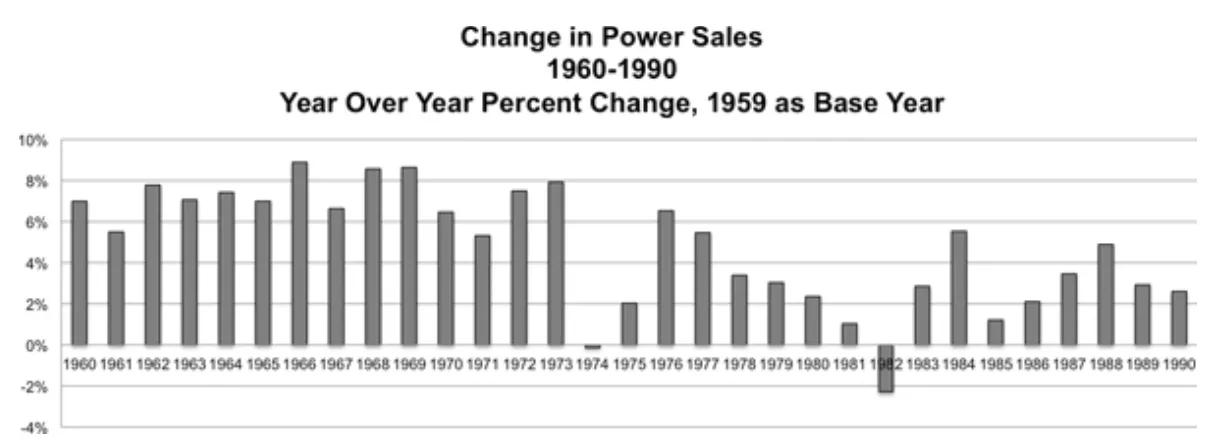

Energy limits our ability to drive change in the physical world—from desalinating water to moving people around a city to manufacturing goods. The public cloud and AI build outs have instigated the first increase in US electricity consumption in over two decades. That said, this increased consumption is, if anything, a return to normalcy. In the early and mid 20th century, electricity consumption increased rapidly.

We used this power for public transit, assembly lines, smelting, street lighting, household appliances, air conditioning, elevators, and more. Similar to the bandwidth glut of the early 2000’s, an energy glut will open new, unpredictable, second-order opportunities.

Energy liberated 90% of humanity from the life of a subsistence farmer. It replaced the doomsday prophecies of Malthus and Ehrlich with mass food production, manufacturing, and transit. To realize a future of increased abundance, the US must return to the Henry Adams Curve.

The US energy market today

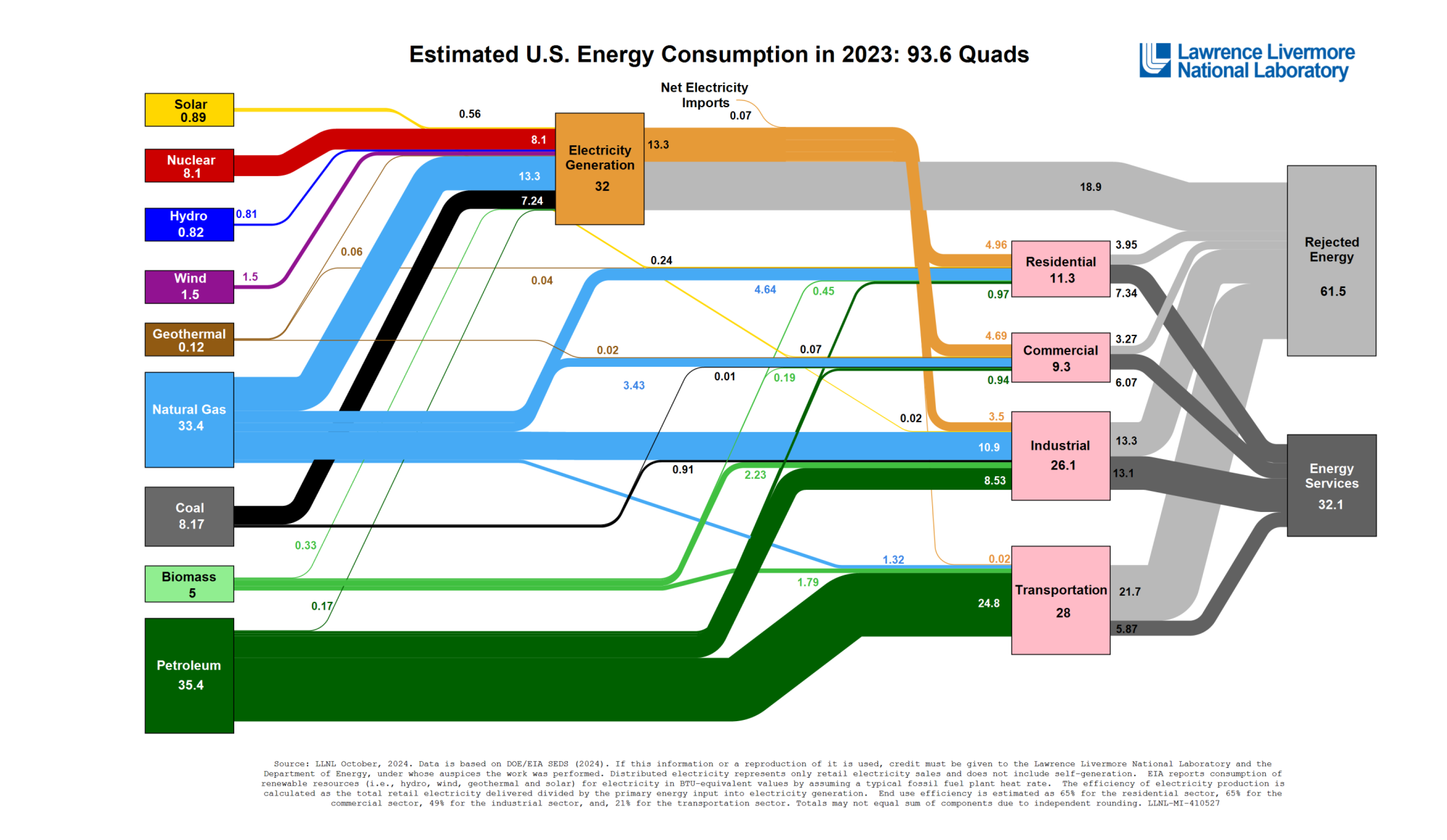

The US energy market is absolutely massive. Electricity accounts for about a third of energy consumption. Most of the remainder comes from petroleum products and natural gas. Residential and commercial users rely on natural gas for space heating, water heating, and cooking—over 50% of US houses still use natural gas heaters. In addition to space heating, industrial customers use natural gas for manufacturing processes (lots of very hot furnaces). Transportation almost entirely relies on petroleum-based fossil fuels. In addition, petroleum fuels the production of many materials—everything from plastics to fertilizers to perfume.

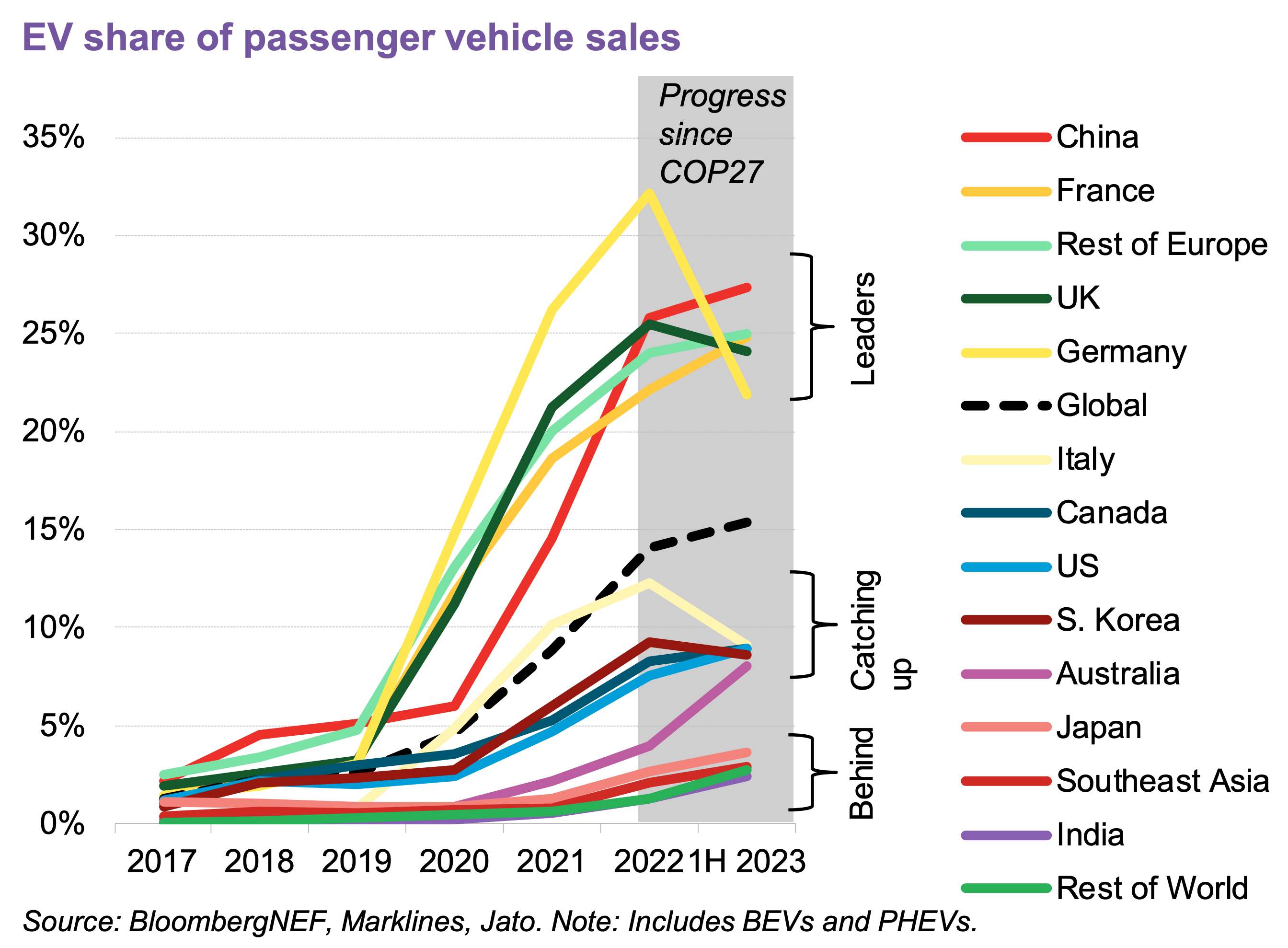

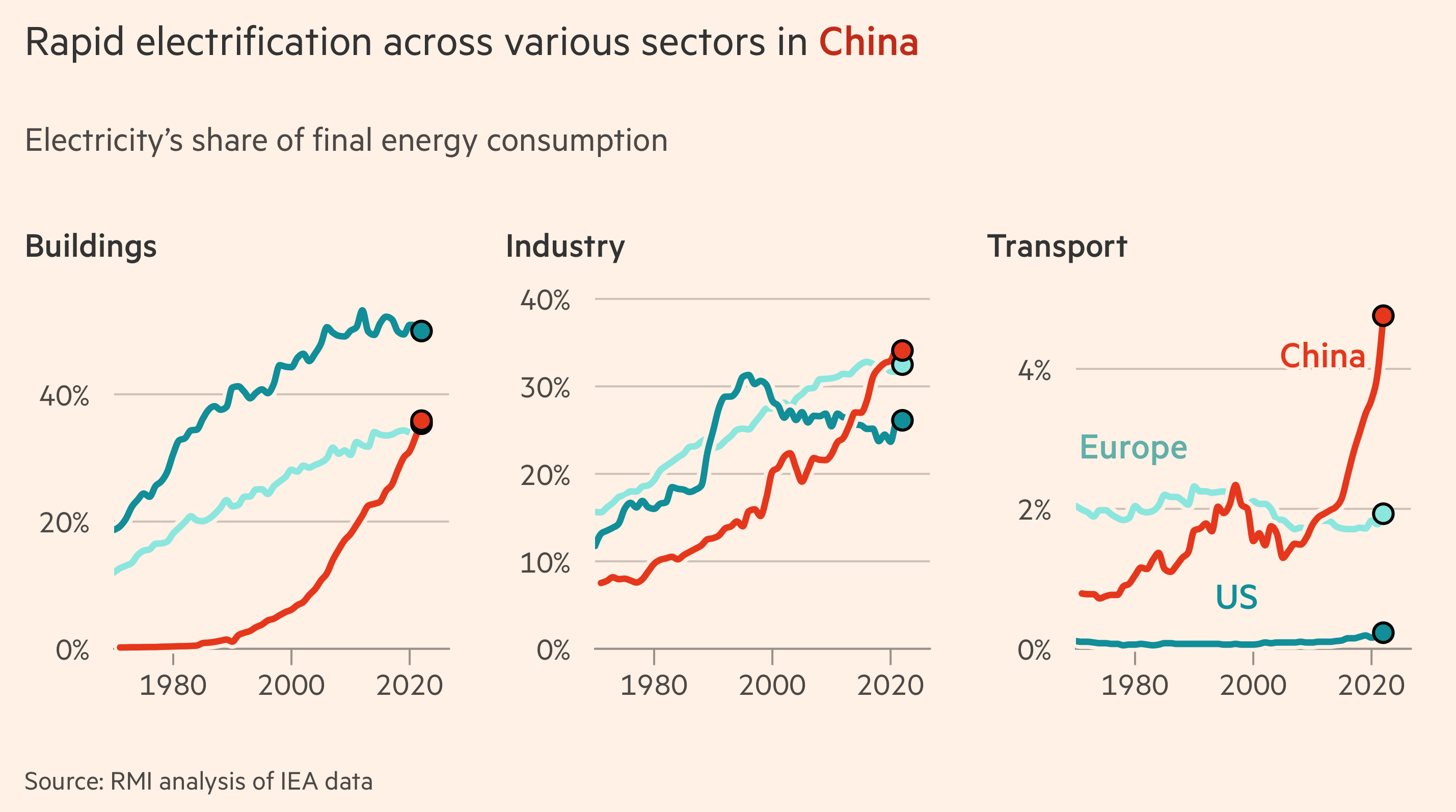

I expect this breakdown of energy usage to change dramatically in the next two decades. As electricity becomes cheaper, we will see the electrification of transportation and of HVAC. Right now, the transition is slow and mostly outside the US.

Trends in electricity markets

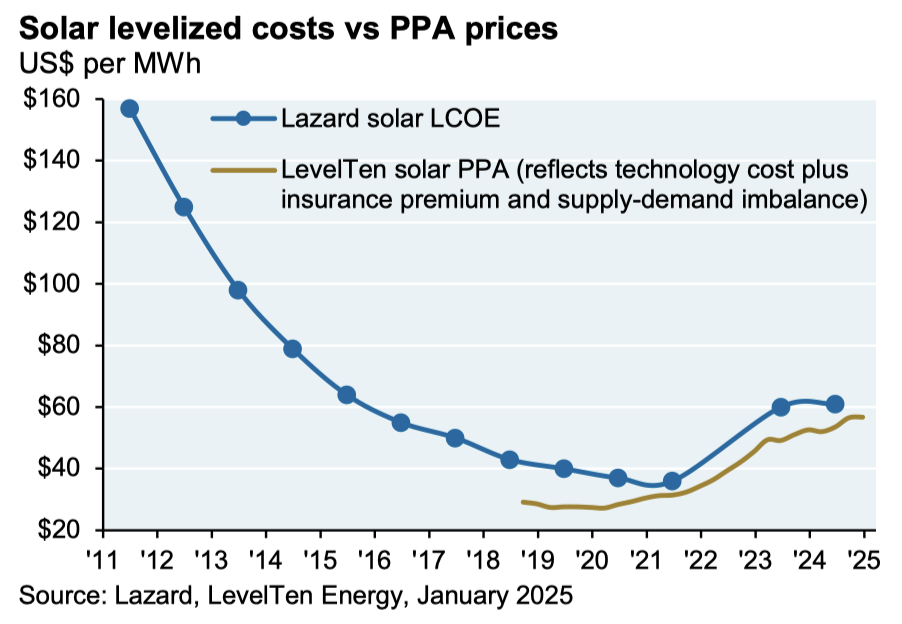

Solar drives falling generation costs

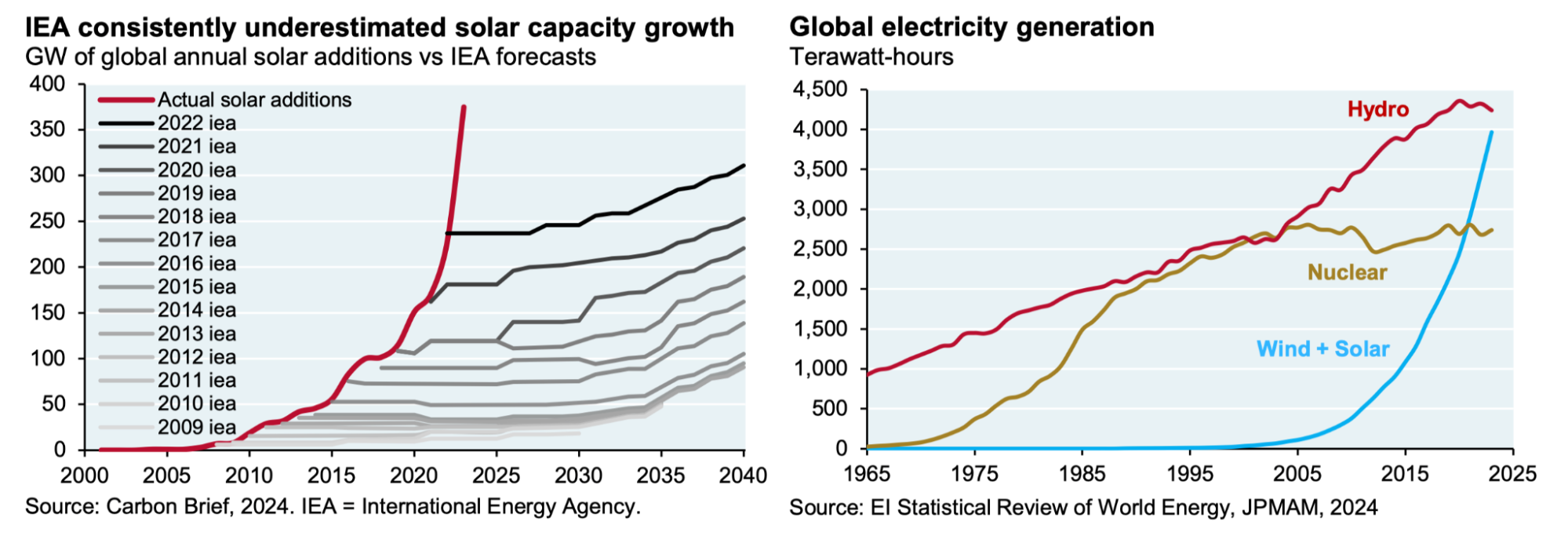

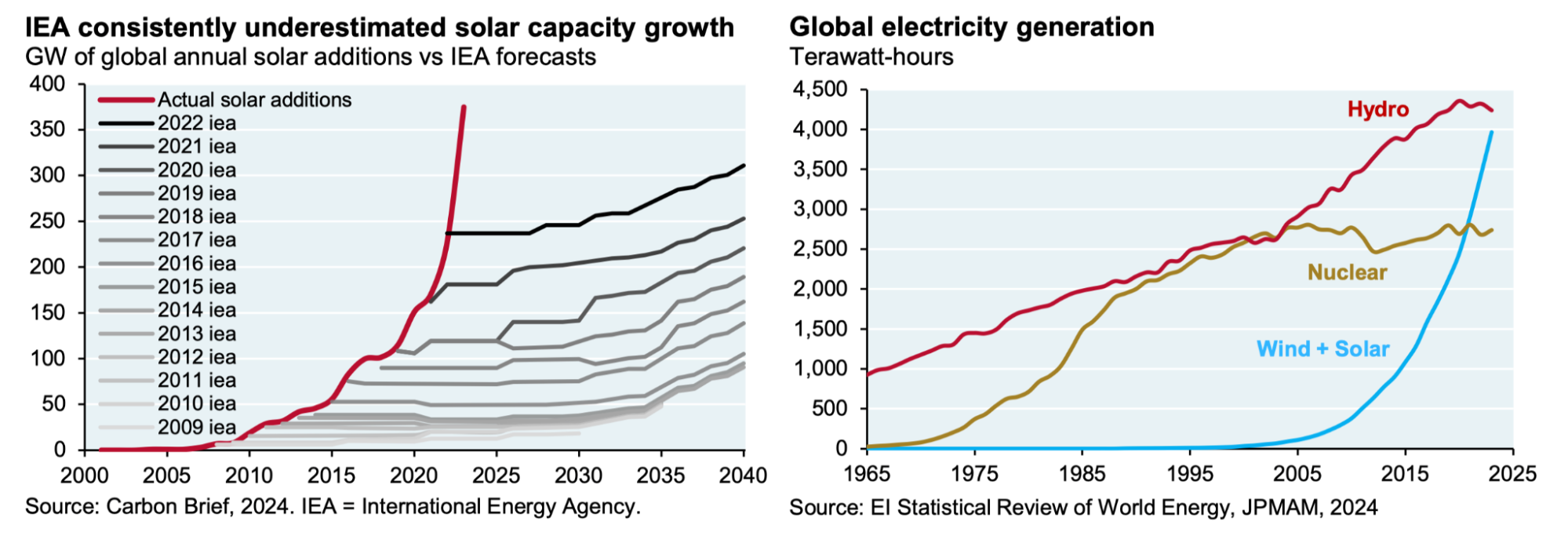

Electricity generation costs continue to fall. Solar primarily drives this decrease, though there are a few dark horses: fission (small modular reactors), fusion, and geothermal. (It’s cheap to pull geothermal energy out of old fracking wells).

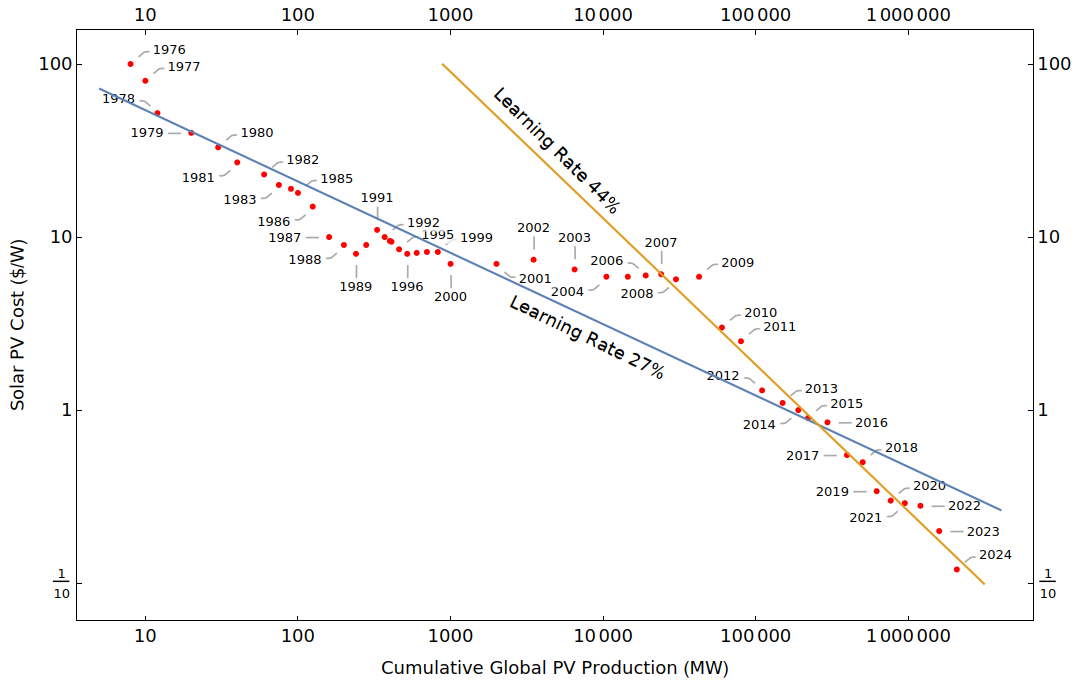

I’m most excited about solar because of the learning curve effects: the price of solar photovoltaic modules drop as cumulative shipped volume increases. In the 20th century, we became really good at building megafactories that churn out cheap products. Much of what was formerly expensive—flatscreen TVs, personal computers, etc—has become insanely cheap. Solar PV cells allow factories to manufacture energy; I and many others are convinced they will continue to become cheaper.

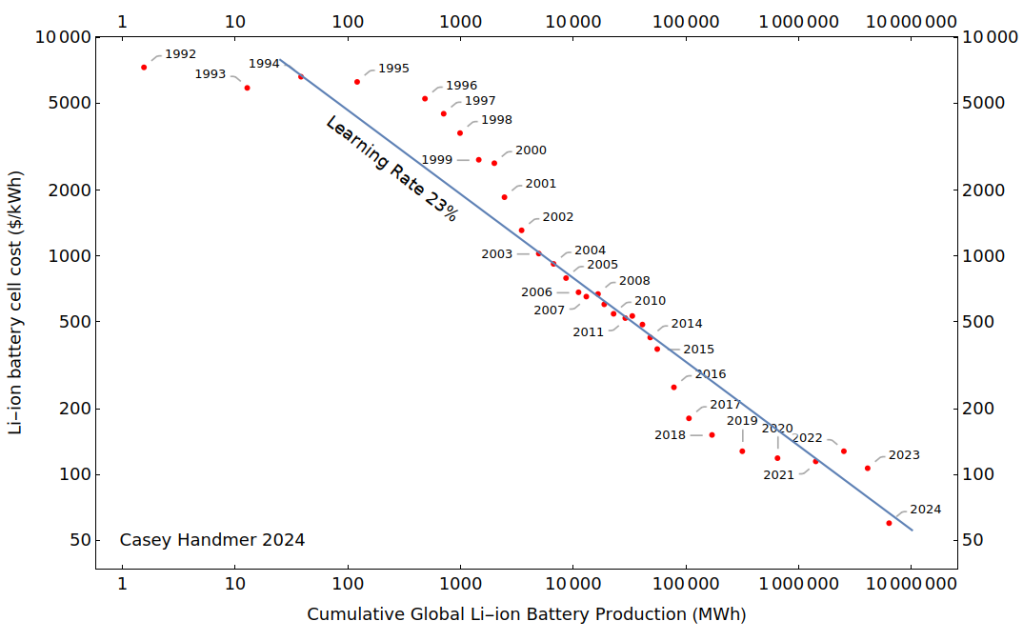

Storage is becoming cheap for the first time

Historically, we didn't have a great way to store electricity. Pumped hydro worked, but these facilities require a large elevation gradient (typically a mountain or deep mine). These siting constraints resulted in limited use. Now, lithium ion batteries are cheap and can be put almost anywhere. Batteries not only enjoy the same learning curve effects as solar PV modules but also enable more solar adoption.

Solar + Batteries

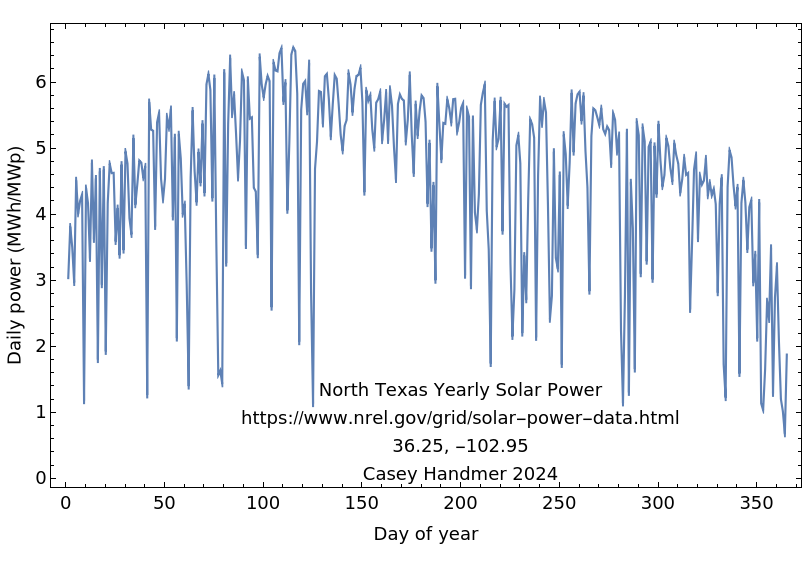

Solar and batteries complement each other. Batteries ameliorate solar’s daily intermittency (below left). As a result, the vast majority of near-term capacity additions (above) and projects in the interconnection queue are solar and battery facilities. Most new solar and battery additions are in Texas and California (below right). This location-dependence results from how the Texas and California grid operators (ERCOT and CAISO) handle new generation; it has little to do with technological limitations (or how much sun Texas gets). There’s still so much whitespace.

Positive feedback loops

Solar pv cells and batteries are both tumbling down their respective learning curves. More produced → cheaper price → more demand → therefore, more produced. This positive feedback loop drives exponential growth. What will we do with cheaper electricity?

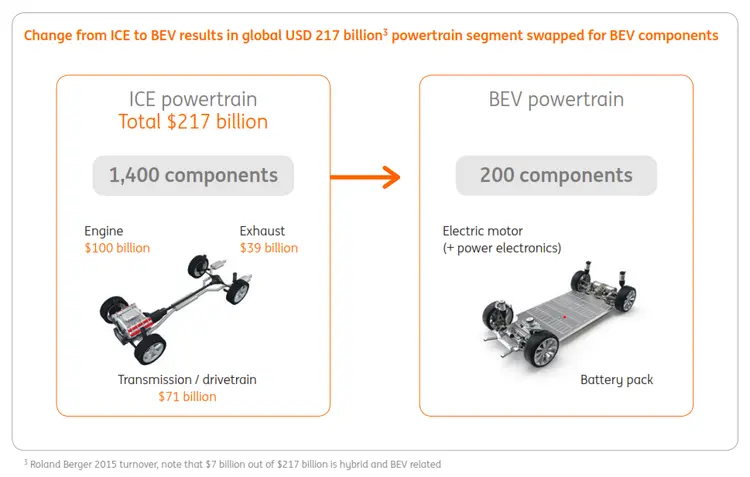

Electrification of transportation. Electric vehicles will become cheaper than internal combustion vehicles. Their design is far simpler, their reliability is better, and their variable costs are lower. As the price of electricity and batteries fall, EVs will become even cheaper. More demand will drive further price reductions as battery production increases and charging infrastructure proliferates. Internal combustion car improvements have plateaued. It’s only a matter of time before EVs dominate. Just look at China (see next section).

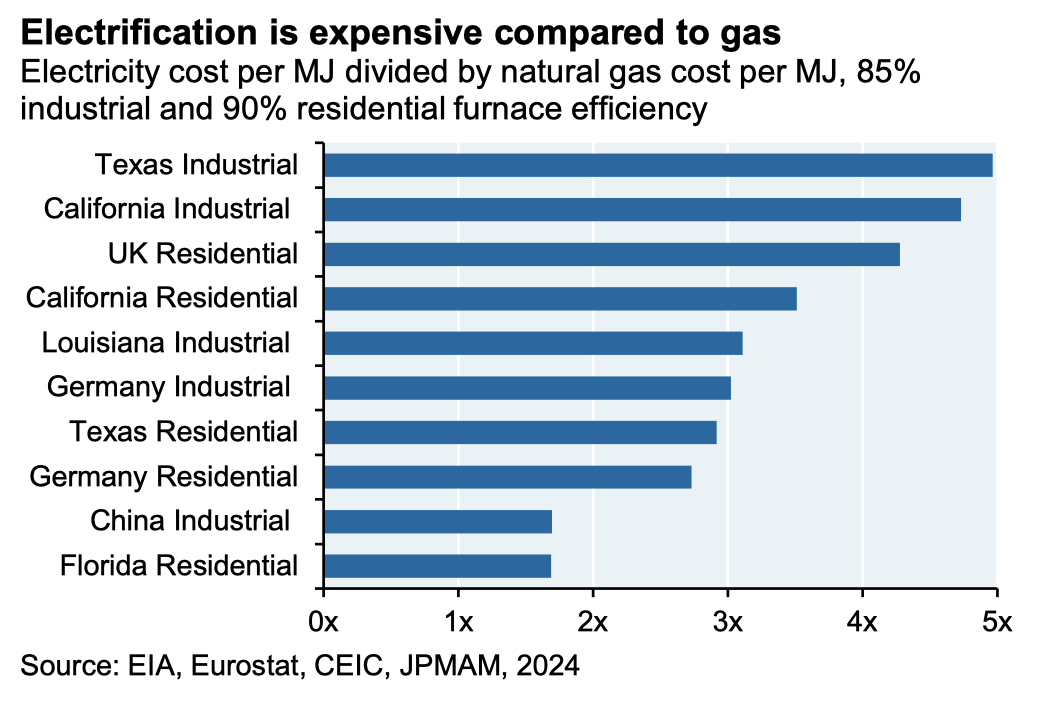

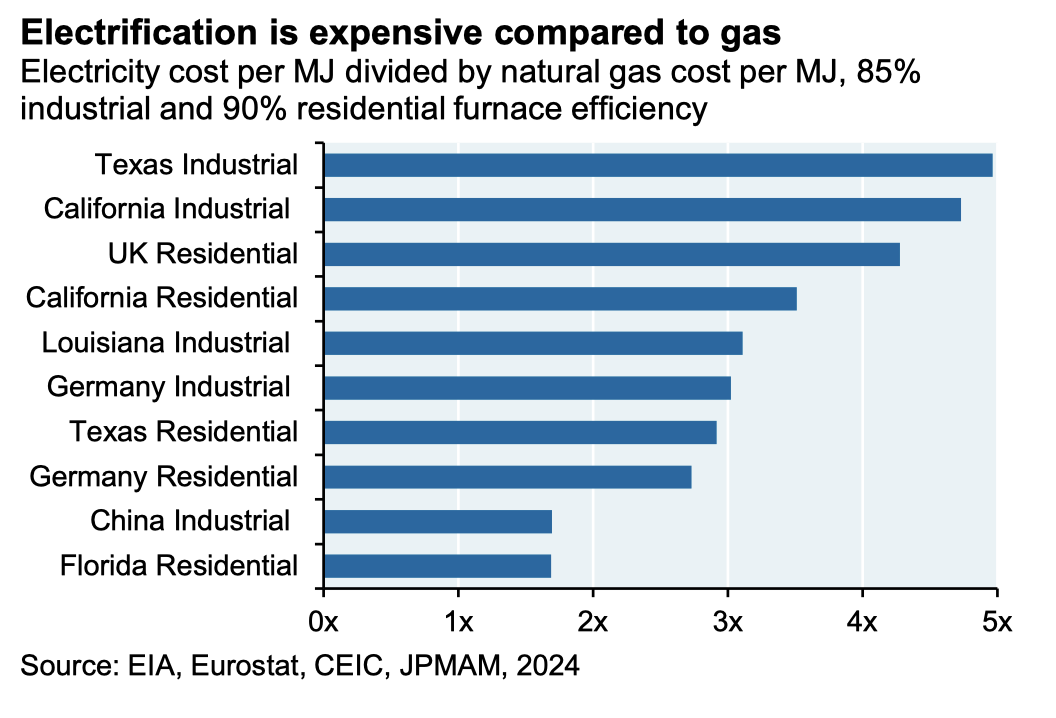

Electrification of other existing use cases. Much of non-electrical energy consumption in the US goes into heating—mostly HVAC but also cooking and water heaters. Natural gas prices have remained largely steady over the last decade, after a dramatic earlier decrease due to hydraulic fracking. Eventually we’ll turn to electric heating and cooking (req. ~60% price drop), driving more demand for electricity & generation, and fueling the learning curves.

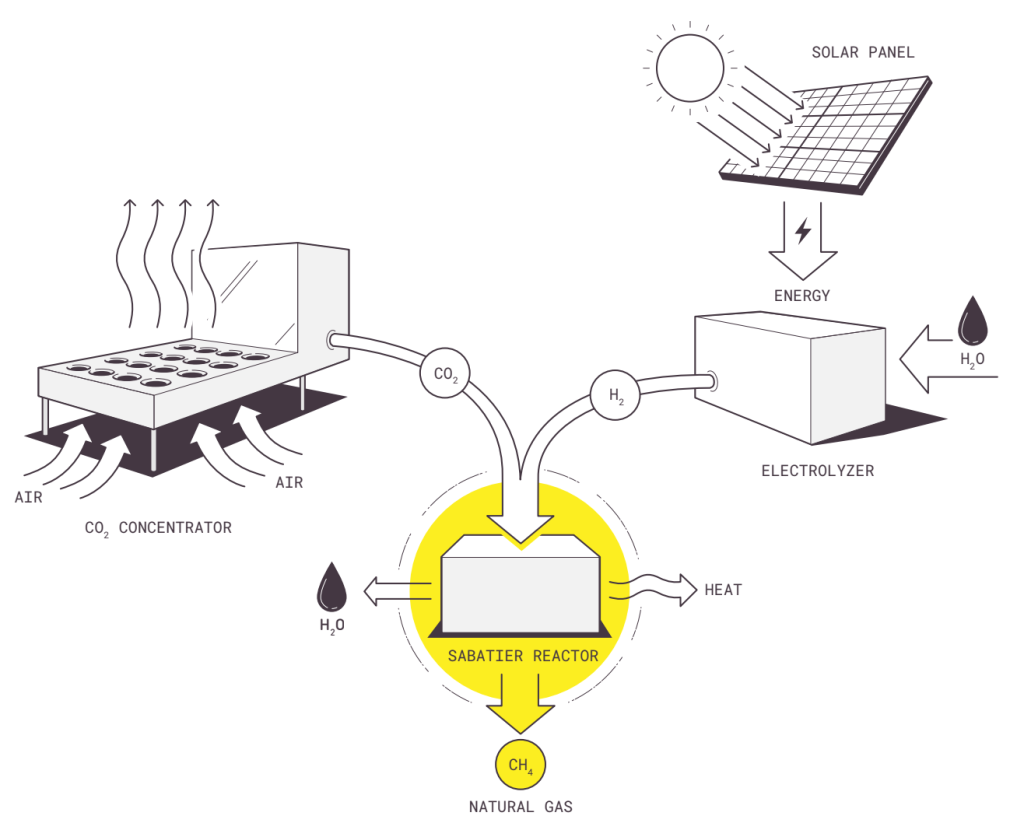

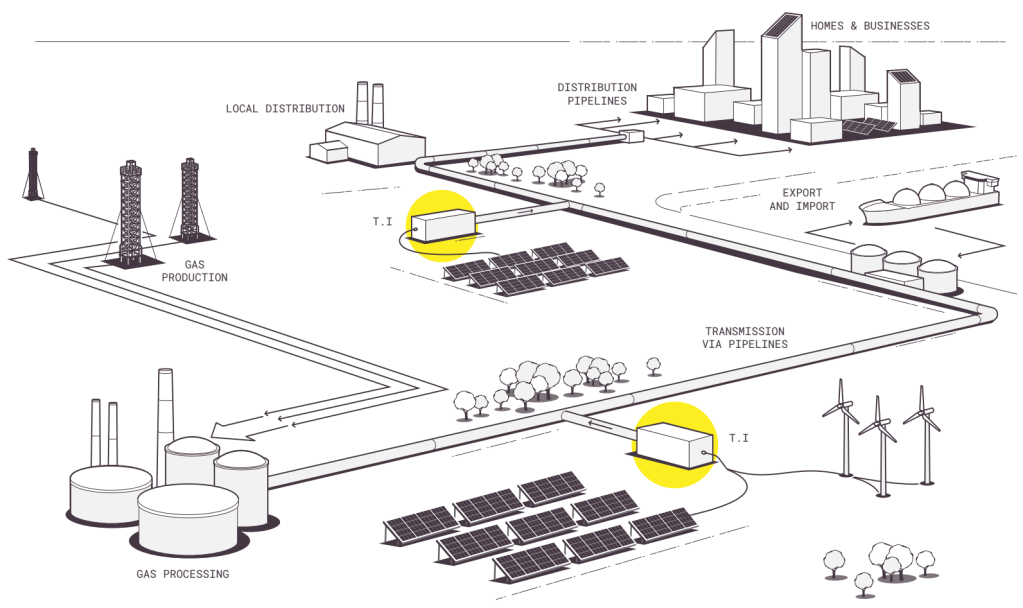

New use cases become economically feasible. Most industrial processes require electricity. The cost of electricity determines the economic feasibility of these processes. (In 1940, production of aluminum and magnesium alone required 1/7 of all electricity in the US!) Newer examples include bitcoin mining, and desalination in the Middle East, where water is relatively expensive and energy is relatively cheap. Cheap enough electricity totally changes the calculus of many processes. We can desalinate the Salton Sea to harvest huge amounts of lithium in our backyard. We can supply water to Southern California without destroying natural habitats. We can economically operate vertical farms that deliver fresh, clean produce to megacities. We can even synthesize carbon neutral natural gas directly from water and atmospheric carbon dioxide. Extracting fossil fuels out of the ground, in the long run, is only getting more expensive. At some point, we’ll be synthesizing these still-essential materials directly not only because it’s more sustainable but also because it’s just cheaper.

The vicious cycle. Both solar and battery-produced energy are mass-manufacturable and therefore enjoy learning curves effects. This is their most important attribute. (Small modular nuclear reactors might benefit similarly; fusion does not.) As demand for electricity increases, electricity will get cheaper, driving more demand, spurring more production, further decreasing the price. The best industrial revolutions are those that fund themselves; they cannot forever rely on government subsidies. I believe solar and batteries are nearly there, and I look forward to the energy glut [1] that will follow. China, I believe, is a harbinger of what’s to come.

China: the electrification bellwether

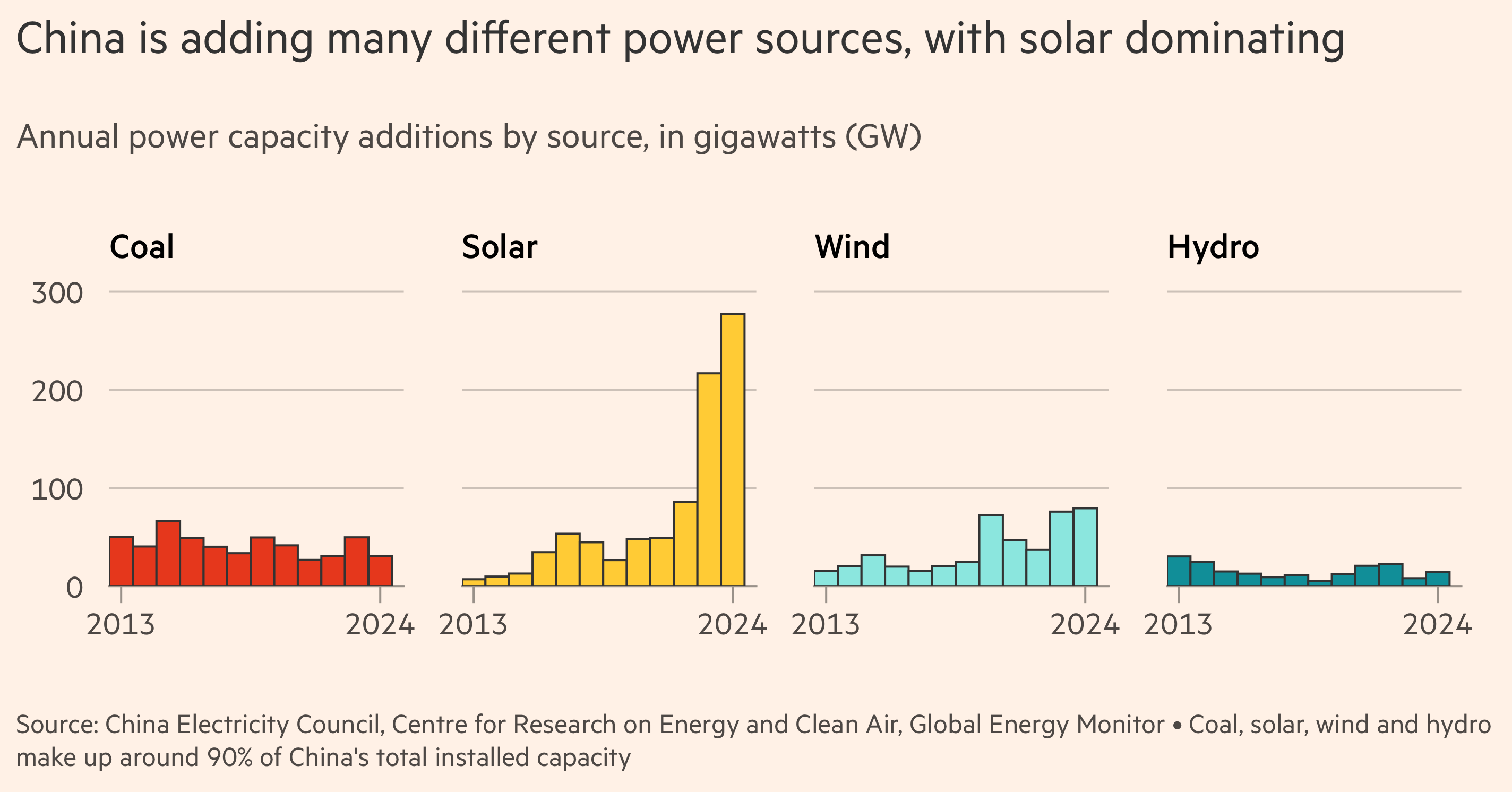

Coal, solar, wind, and hydro account for 90% of China’s electricity generation. Solar power now dominates new electricity generation. This lead isn’t because China cares about the environment [2]; it’s because solar is cheaper.

Cheap power has prompted an electrification of end use cases. EVs are becoming cheaper than regular cars, driven by cheap electricity and batteries. Buildings and industry, traditionally heavy users of natural gas, are also shifting to electricity. I believe China is a harbinger of what’s to come, as the economics of solar and batteries there begin to diffuse to the rest of the world.

Electricity markets

The energy market is mind-blowingly massive: a multi-trillion dollar market globally. Yearly profits in oil and gas are on the order of hundreds of billions of dollars, with most revenue going to the upstream players. (It pays to dig holes.) Power is a ~$500B market in the US, which I expect to grow over the next few decades.

In an electrified world, there will be a huge opportunity for companies that can internalize risk on behalf of end users. These companies will facilitate the large-scale use of very cheap but highly volatile generation sources (my hypothesis: primarily solar) and will ameliorate the impact of the aging and sclerotic transmission infrastructure. The grid originated to mitigate risk. New sources require an evolution in how we manage and operate it.

New risk managers

Most power consumers do not want to run trading desks. They want their electricity at cheap, reliable prices that they can plug into Excel spreadsheets. Oil companies (mostly) shield prices at the pump from the dramatic booms and busts of oil exploration. Entities that internalize risk will play a similar and increasingly valuable role in the electricity supply chain. This role becomes more important as electricity generation shifts to more volatile sources, especially given sclerotic transmission growth.

With a solar-dominated grid, integrated load service entities—ones that control both generation assets (e.g., battery farms) and end-user relationships (e.g., PPAs with large industrial or commercial entities)—will become the dominant players. These players have the best access to load information through their retail contracts, and they can better hedge price volatility by owning generation assets. Similar to the oil and natural gas industries, the electricity industry will likely consolidate, with major players owning various categories, defined by the generation technology, customer profile, geography, and so on. The next generation of risk managers will enable dirt cheap but highly volatile electricity sources to reliably power the future US economy.

Final thoughts

We’re in a once-in-a-century transition of humanity’s marginal energy source. New technologies are decreasing the price of electricity generation, and new use cases are increasing electricity demand. These trends show no signs of abating.

At the turn of the 20th century, Standard Oil enabled the US to transition from coal to petroleum as the marginal energy source. The internal combustion engine replaced the steam engine. This transition gave us everything from ubiquitous lighting to air travel. I believe that the next Standard Oil will emerge in the coming decades, unlocking a new era of gains in human capability and prosperity.

Acknowledgements

Thank you to Alex Kurland, Konstantine Buhler, Logan Engstrom, Logan Spear, Max Franzblau, Michael Retchin, Ryan Cohen, and Zach Diamandis for helpful comments on earlier versions of this essay. I'm also grateful to the many others who gave me advice during my sabbatical.

Footnotes

| [1] | I expect these changes to play out over a ten to twenty year horizon. That said, the early signs are already here. The US is projected to increase solar by ⅓ in 2025, and batteries often supply ~25% of CA electricity in the evenings. (This number might be out of date soon.) |

| [2] | China leads the world in coal power additions. |

Supplemental Info & Figures

This year's JP Morgan report had lots of great figures. I included many below.

Worldwide solar growth is rapid, well ahead of most predictions.

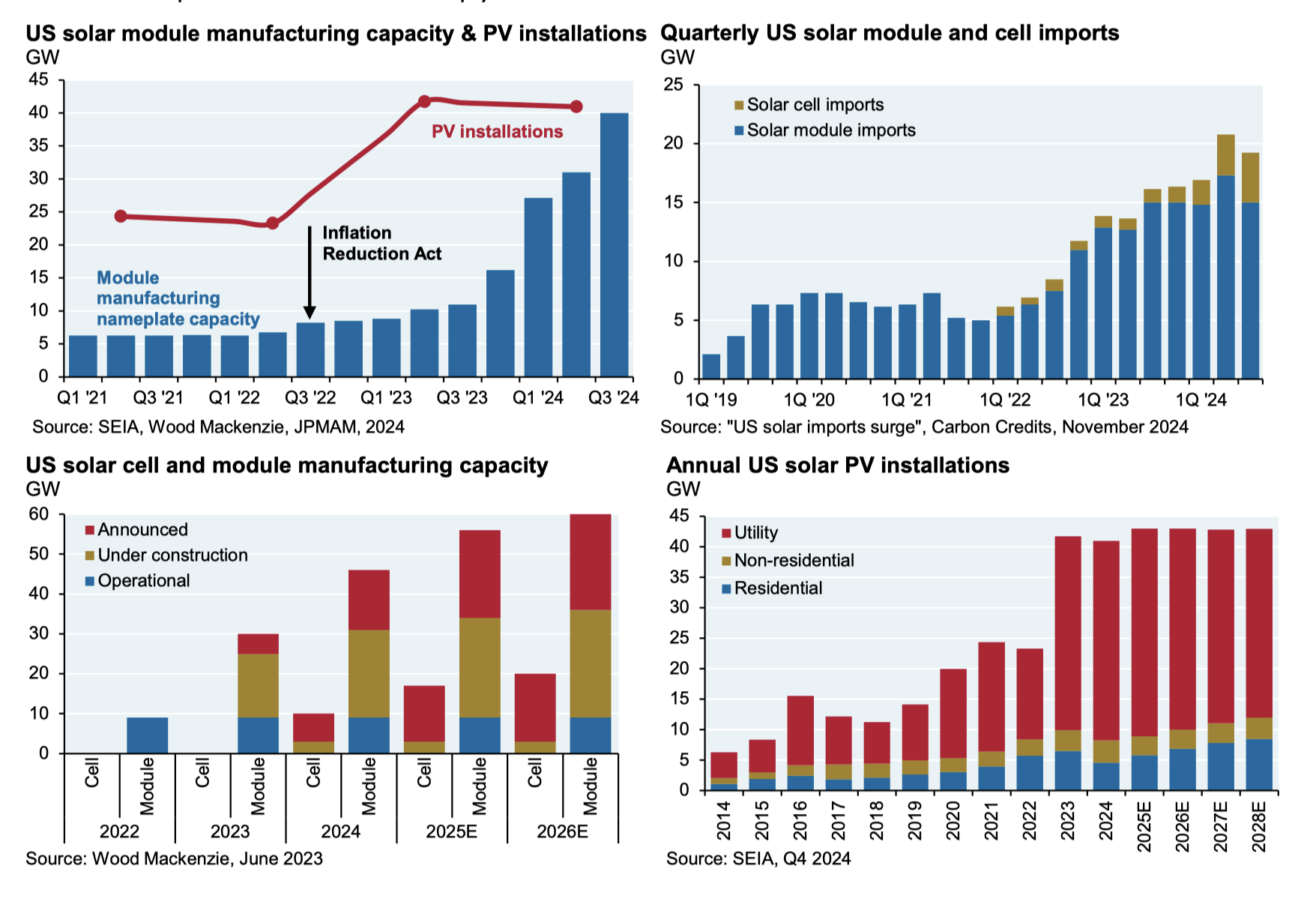

US solar growth and capacity has not yet caught up. Panels in the US are 2-3x more expensive per watt than in the rest of the world. More expensive panels require axis trackers to justify costs, driving up labor and other materials costs. Less expensive modules (around ⅓ of current costs) will quickly reduce fieldwork and balance of system costs, which will further depress utility scale solar price. I hope we hit a “tipping point” in the next 5 or so years.

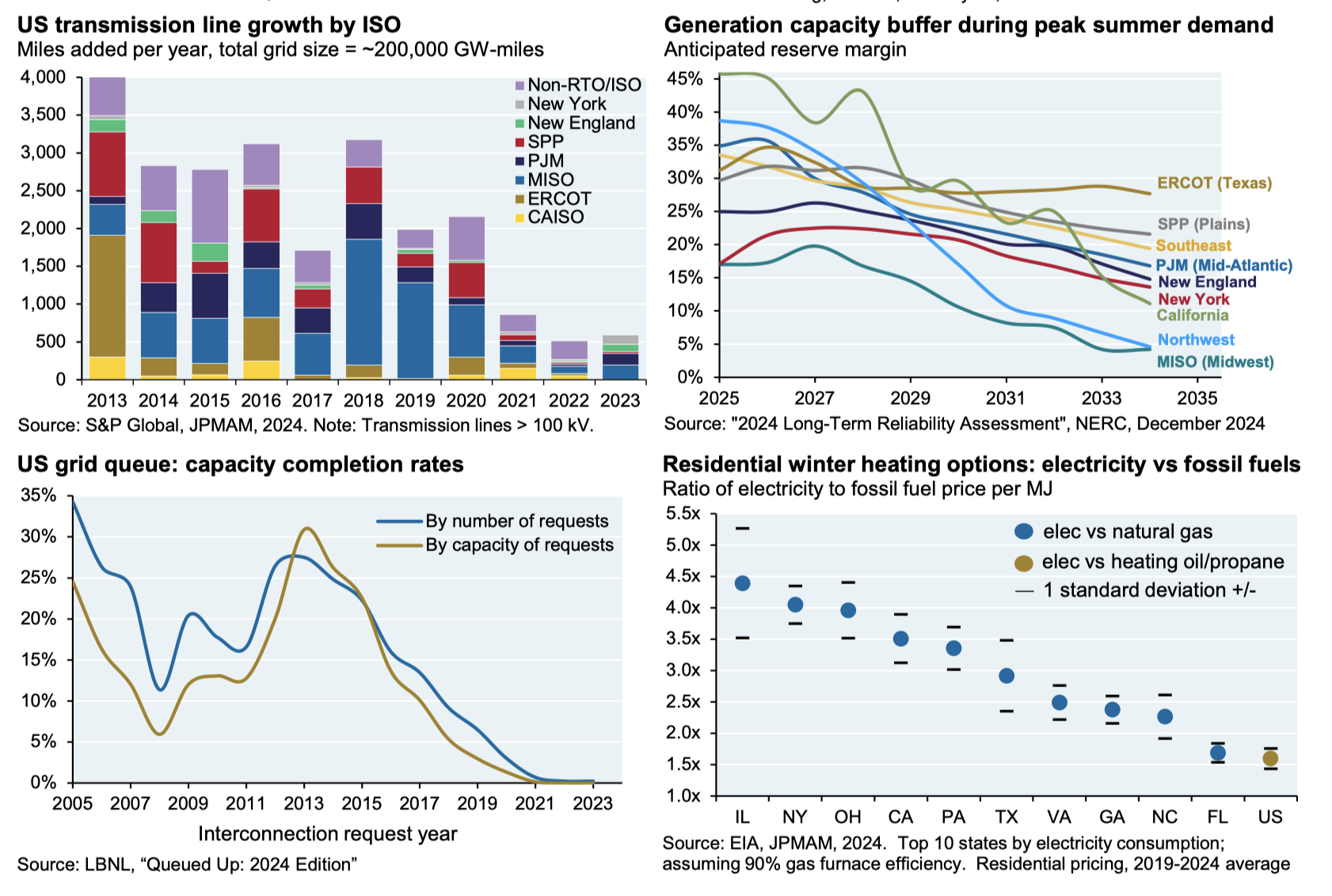

Transmission line growth in the US is pathetic, resulting in high congestion costs. As far as I can tell, the fixes are policy: eliminate much of NEPA, and give FERC siting authority for high voltage transmission lines, similar to its authority for natural gas lines. In the meantime, we’ll likely see more growth within individual states (TX, CA) and more distributed energy generation and storage. I’m optimistic we'll solve this policy problem in the medium term.

Electrification of heating still doesn’t make sense, but with an order-of-magnitude drop in electricity prices, we’ll see large-scale deployment of electric heat pumps. I suspect we’ll see this start within the next decade.

Image credits

(In order of appearance)

1: Ian Morris, The Measure of Civilization

2: Lam Thuy Vo / NPR, using data from US EIA and Census Bureau, Two centuries of energy in America, in four graphs

3: EIA, Use of electricity

4: Richard F. Hirsh and Jonathan G. Koomey, Electricity Consumption and Economic Growth: A New Relationship with Significant Consequences?

5: Julie Cohn, The Grid (found on Brian Potter’s The Grid, Part II)

6: Todd Moss and Jacob Kincer, How does energy impact economic growth? An overview of the evidence

7: J Storrs Hall, Where’s my flying car? (found on The Roots of Progress)

8: Lawrence Livermore national lab, Energy flow charts

9: Michael Cembalest, Heliocentrism: Objects may be further away than they appear

10: Bloomberg NEF, Zero-Emission Vehicles FactBook

11-12: Casey Handmer, The solar industrial revolution is the biggest investment opportunity in history

13: EIA, U.S. developers report half of new electric generating capacity will come from solar

14: Casey Handmer, Solar and batteries for generic use cases

15: EIA, Solar, battery storage to lead new U.S. generating capacity additions in 2025

16: EIA, STEO Between the Lines: Small-scale solar accounts for about one-third of U.S. solar power capacity

17: EIA, U.S. battery capacity increased 66% in 2024

18: Dale Cohen, Electric Vehicle convergence point approaches

19-20: Terraform Industries, We’re going to need a lot of solar panels

21: Michael Cembalest, Heliocentrism: Objects may be further away than they appear

22-23: Jana Tauschinski and Nassos Stylianou, How we made it: will China be the first electrostate? (Financial Times)

24: EIA, U.S. developers report half of new electric generating capacity will come from solar

Supplement: Michael Cembalest, Heliocentrism: Objects may be further away than they appear